Image 1 of 14

Image 1 of 14

Image 2 of 14

Image 2 of 14

Image 3 of 14

Image 3 of 14

Image 4 of 14

Image 4 of 14

Image 5 of 14

Image 5 of 14

Image 6 of 14

Image 6 of 14

Image 7 of 14

Image 7 of 14

Image 8 of 14

Image 8 of 14

Image 9 of 14

Image 9 of 14

Image 10 of 14

Image 10 of 14

Image 11 of 14

Image 11 of 14

Image 12 of 14

Image 12 of 14

Image 13 of 14

Image 13 of 14

Image 14 of 14

Image 14 of 14

Personal Budget Planner

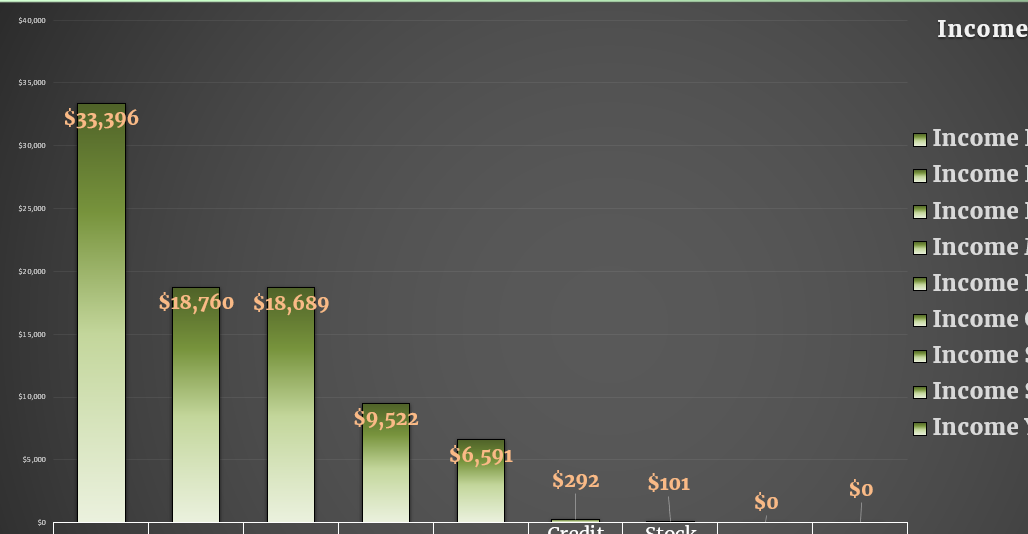

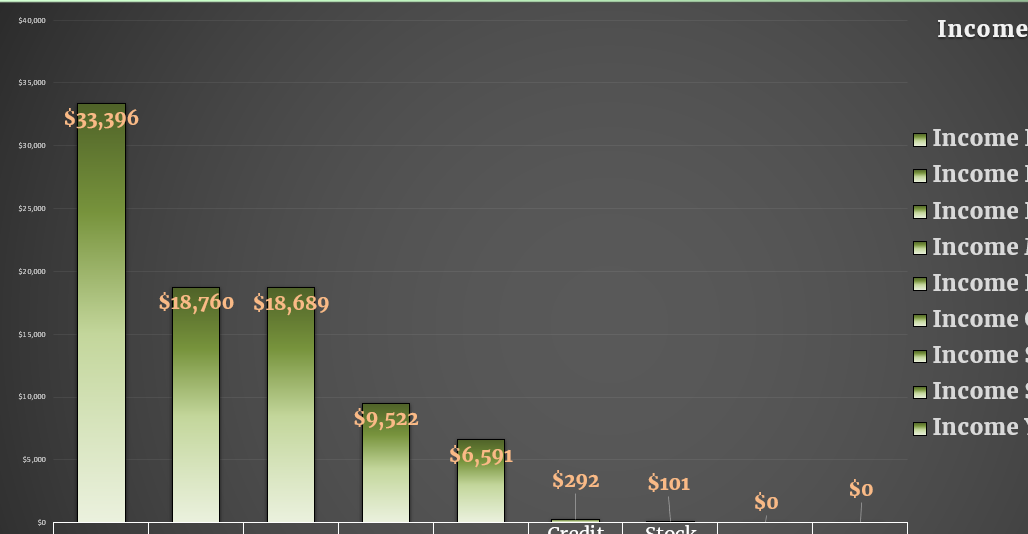

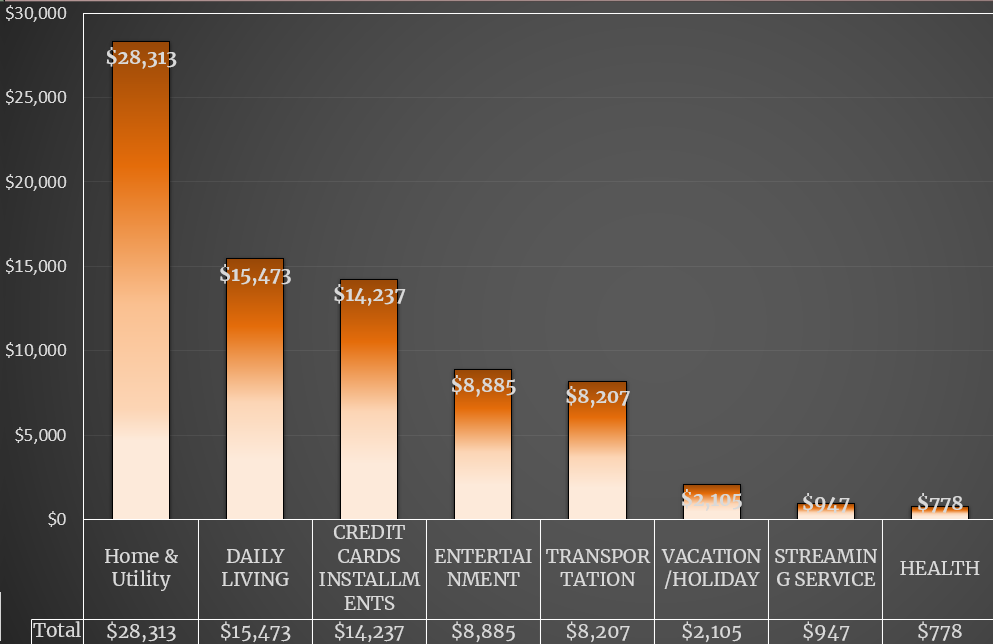

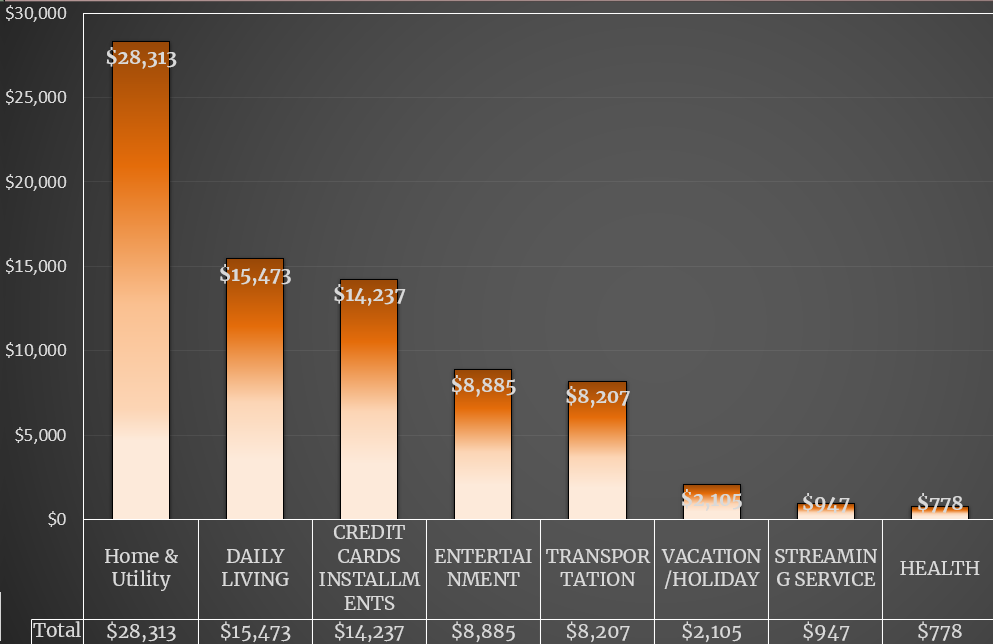

A budget planner I created myself. It has everything you need to keep track of your expenses. This budget planner will put you on the right path to success! Keep track of what you make, spend, and how much you’re actually profiting Month over Month. The budget planner also has a tab for rental properties, stocks, amortization schedule, Debt-to-income ratio calculator, and a repair tracker for rental properties. ANY update I make to my budget planner will be shared with buyers for FREE. Additionally, when the new year comes along, a new budget planner will be sent as well with updates.

INCLUDES THE FOLLOWING TABS:

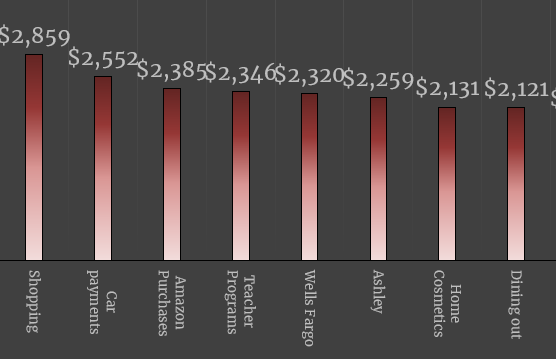

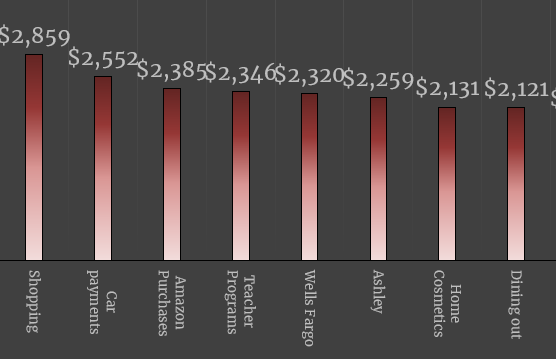

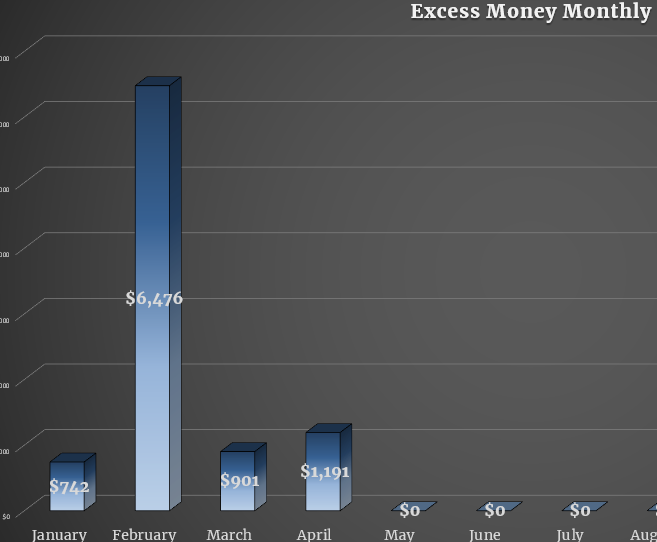

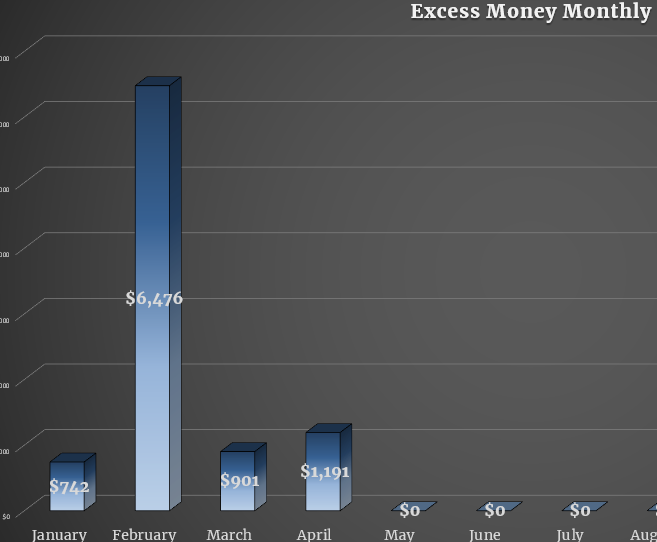

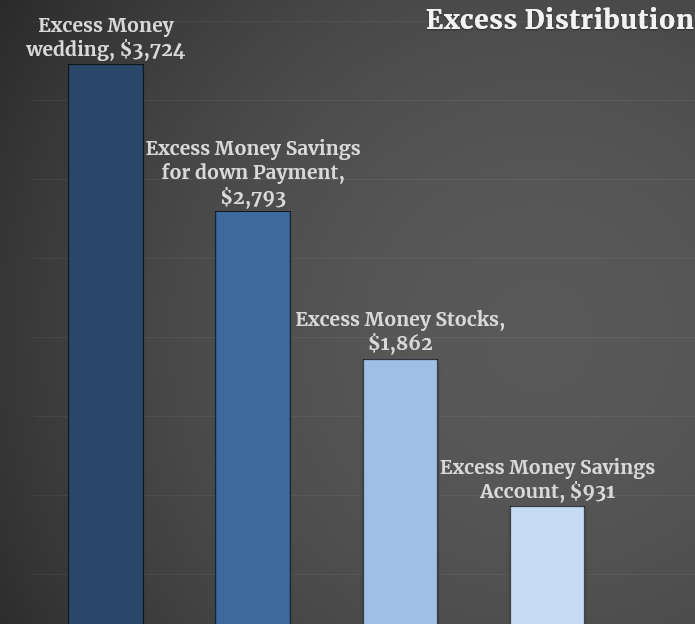

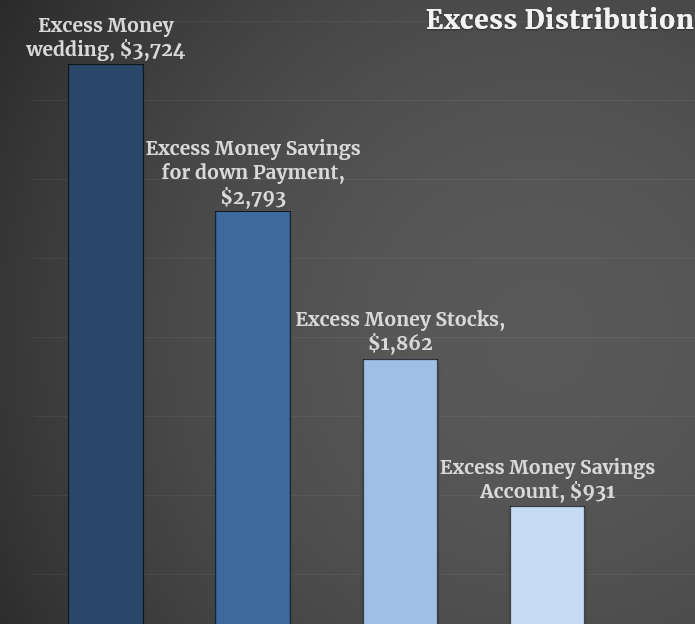

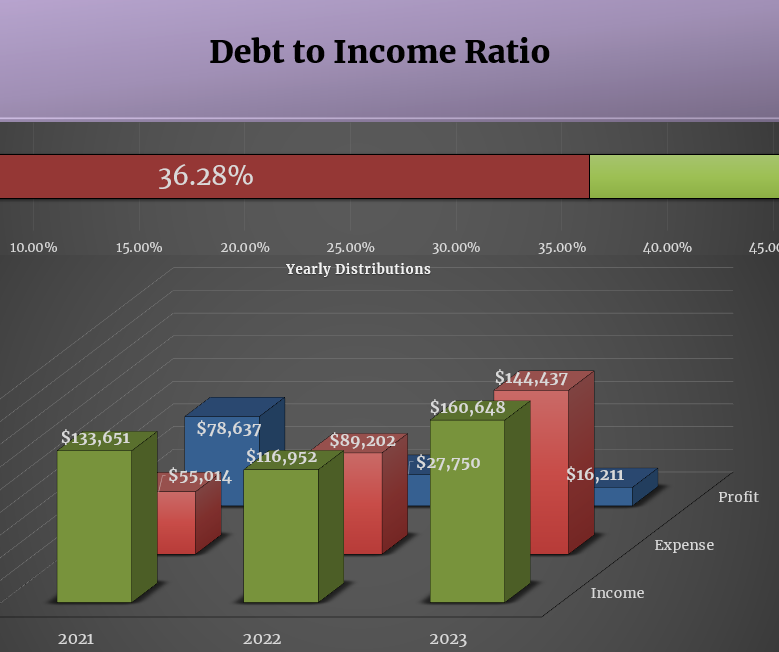

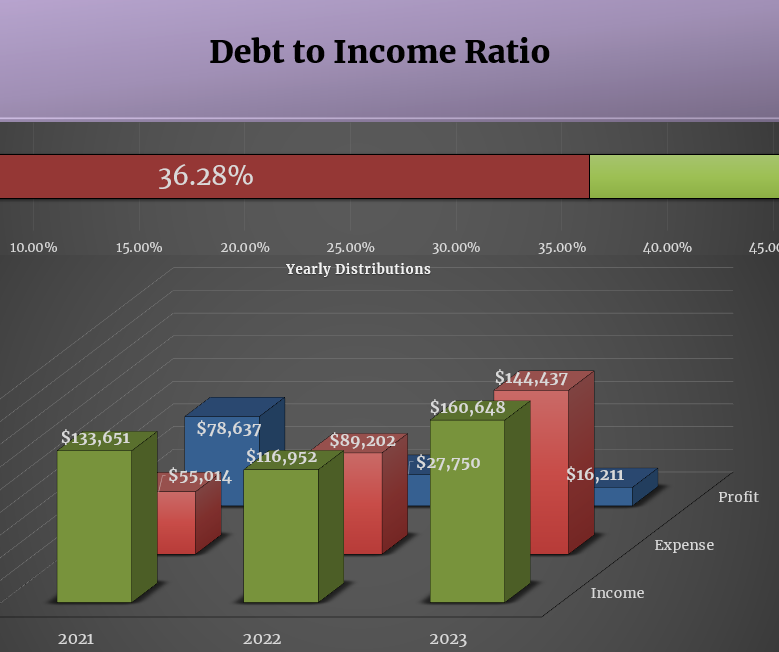

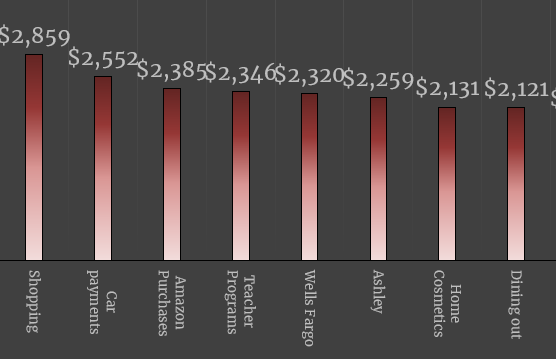

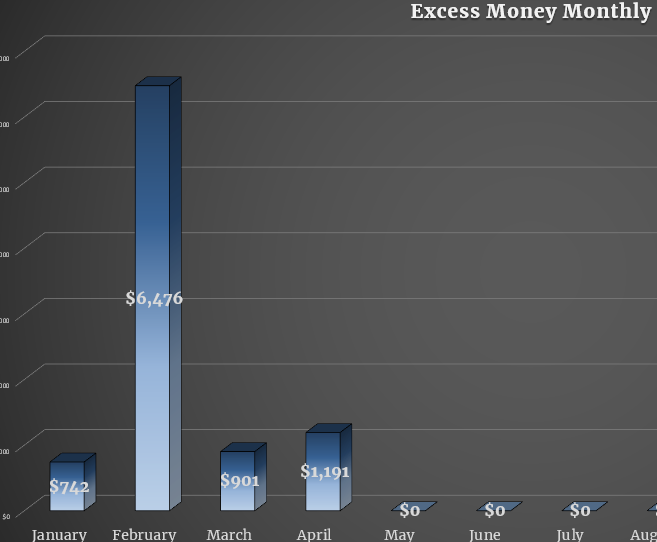

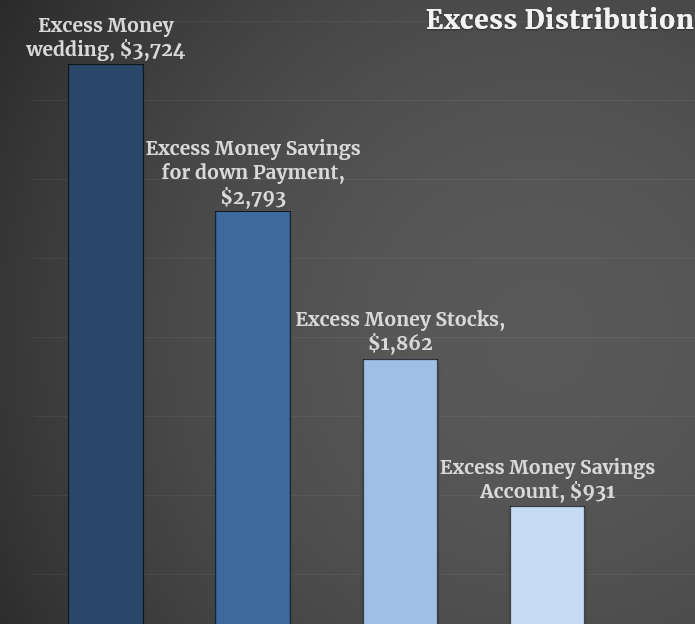

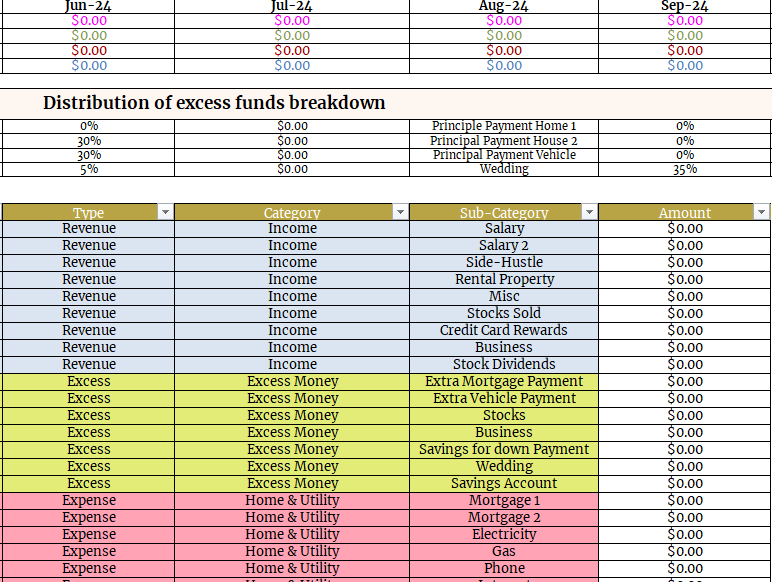

Full interaction Dashboard that tracks both income and expenses together in a line graph. Individual revenue, expense, and profit section that outlines EACH major areas. This allows you to easily see where the bulk of your revenue comes from, and where your expenses go to. There is a sub-category for expenses so you can drill down to the exact expenses which allows you to easily pivot. The interaction dashboard also shows excess, debt to income ratio, yearly distributions, and a rental property breakdown.

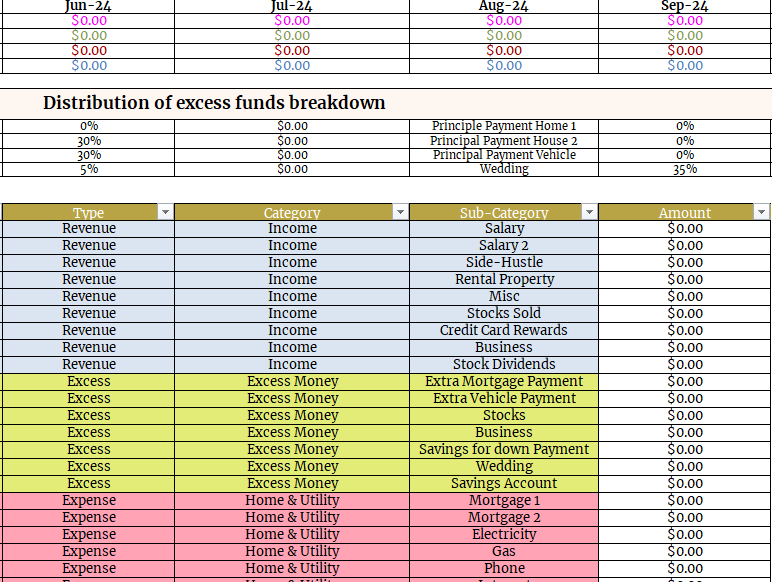

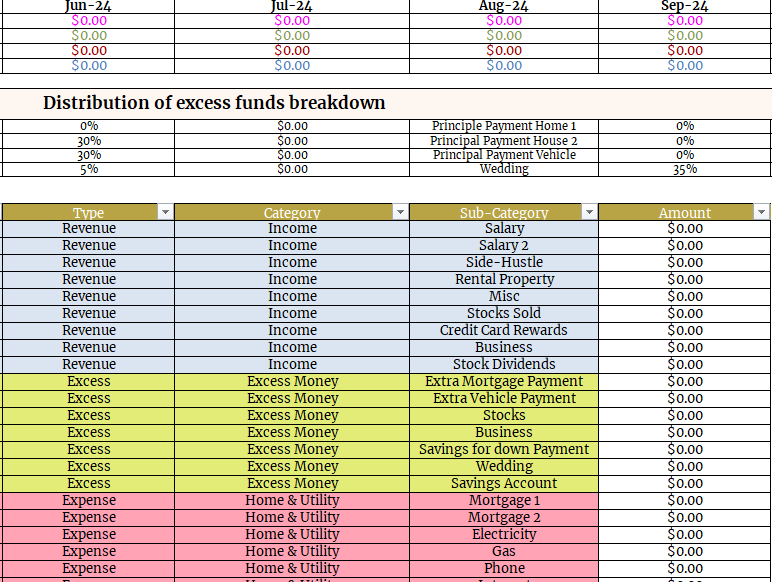

Budget input where you add your expenses and revenues for each month. table on top shows you the results instantly for each month

Rental property breakdown if you own rental properties. You can add the details here and it will calculate the ROI, COC, total rental income invested and much more

Property Repair Cost Tracker that allows you to see how much you spend on repairs for your rental properties

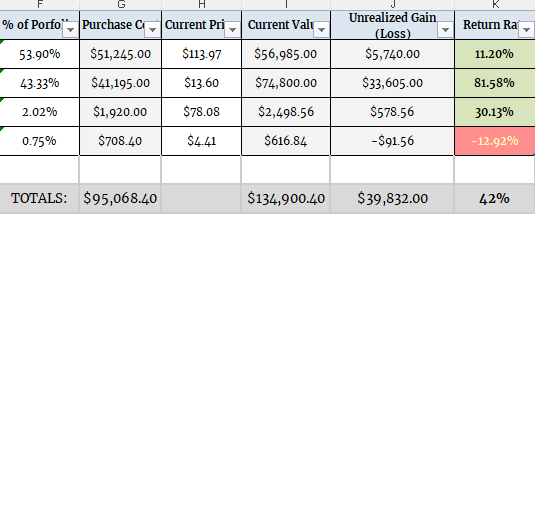

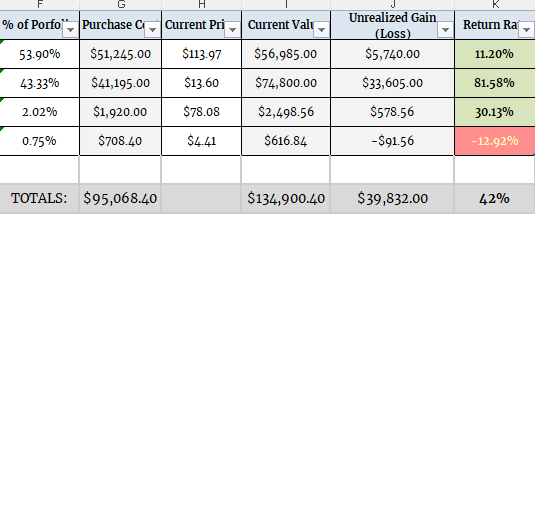

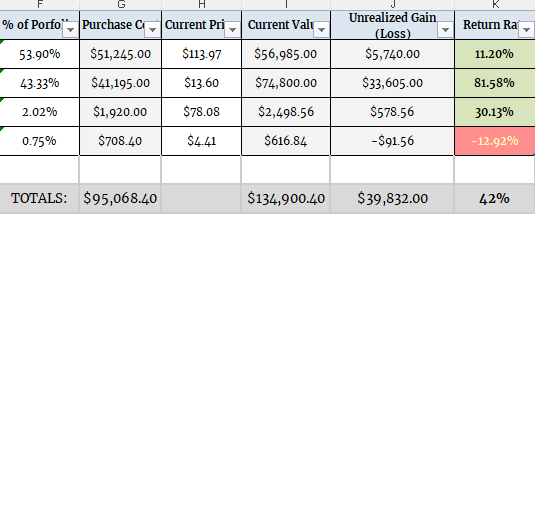

Stock Portfolio tab that allows you to place all your stocks. This helps you track your return. There is a table that you can use to see how much money you want to distribute into your favorite stocks.

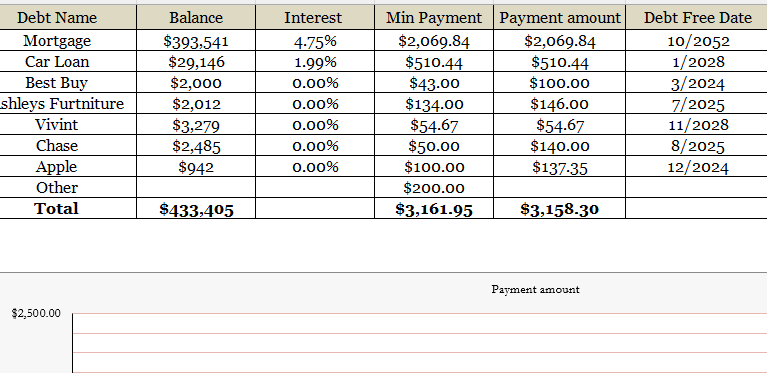

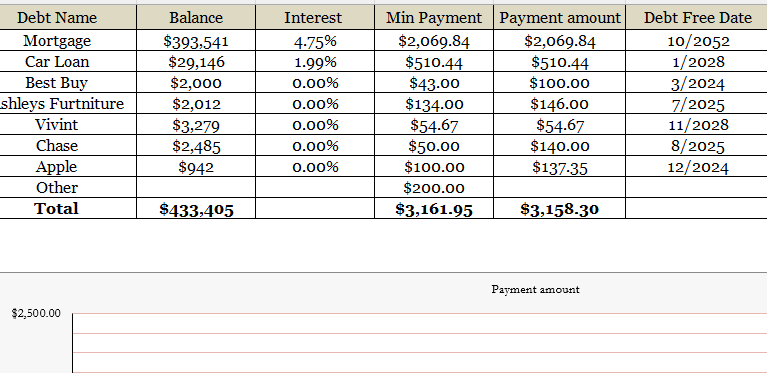

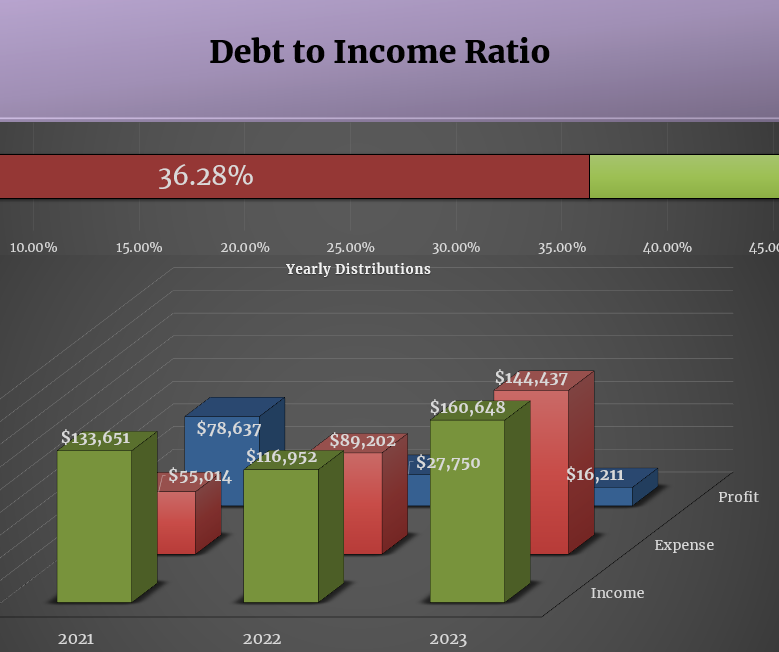

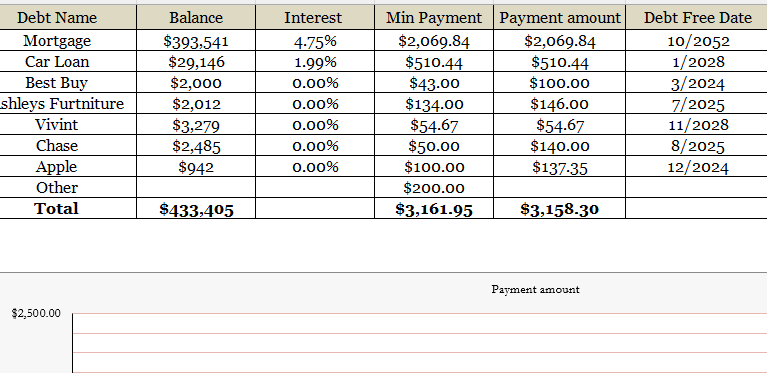

Debt-to-Income tab where you place your loans and credit card payments. After putting your annual gross salary, it will calculate what you DTI ratio is and helps you track your biggest loans.

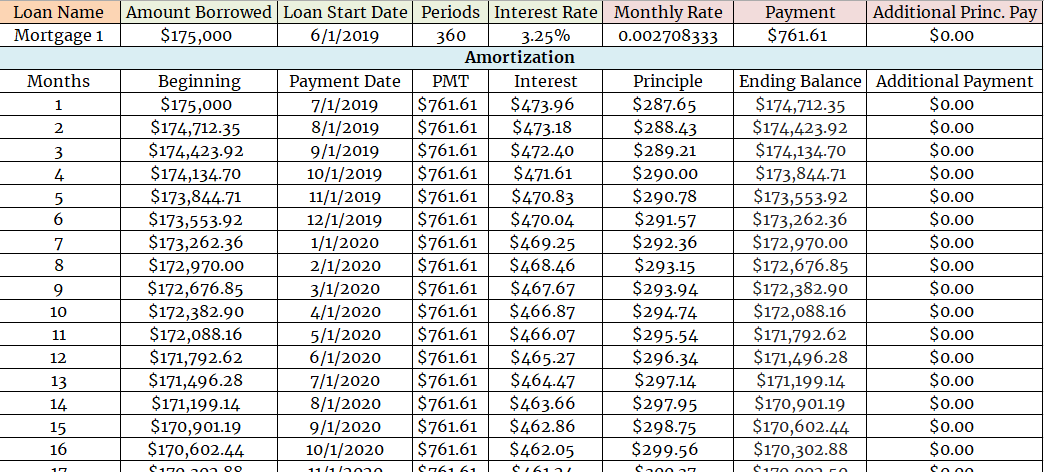

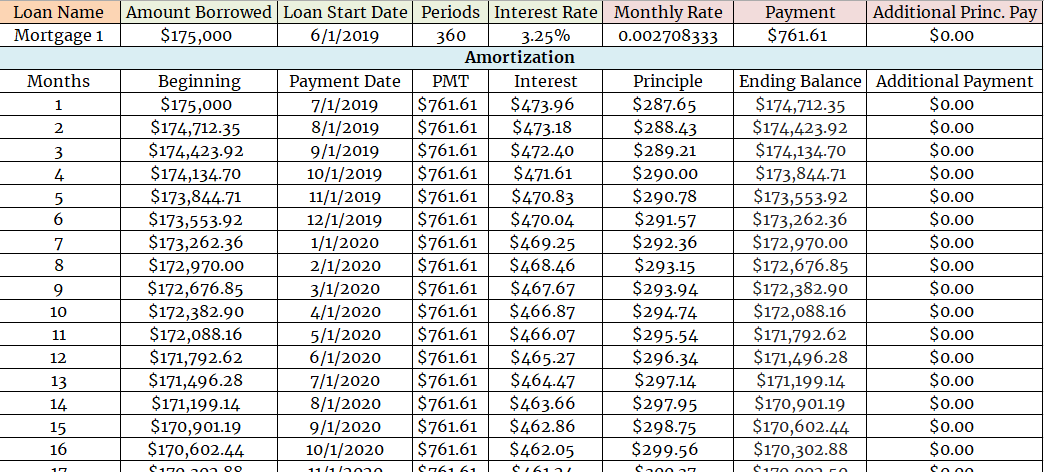

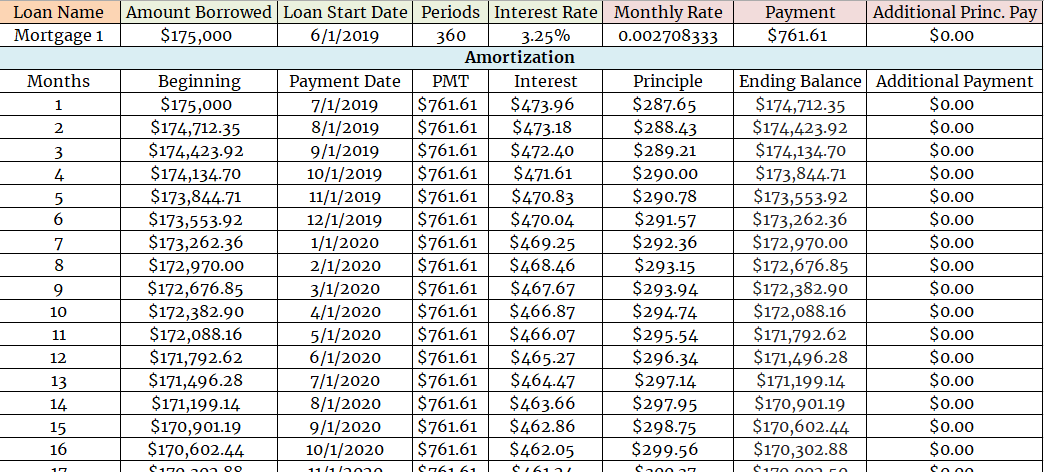

Amortization table where you can put the information for your loans. This helps you see how much impact your principle payments will have.

Instruction tab

*ANY pre-filled information on the budget planner is NOT meant to be a guide for you to purchase or follow. It is simply there for instructional purposes.

*INSTRUCTIONS section also on excel. You may email us for any assistance.

A budget planner I created myself. It has everything you need to keep track of your expenses. This budget planner will put you on the right path to success! Keep track of what you make, spend, and how much you’re actually profiting Month over Month. The budget planner also has a tab for rental properties, stocks, amortization schedule, Debt-to-income ratio calculator, and a repair tracker for rental properties. ANY update I make to my budget planner will be shared with buyers for FREE. Additionally, when the new year comes along, a new budget planner will be sent as well with updates.

INCLUDES THE FOLLOWING TABS:

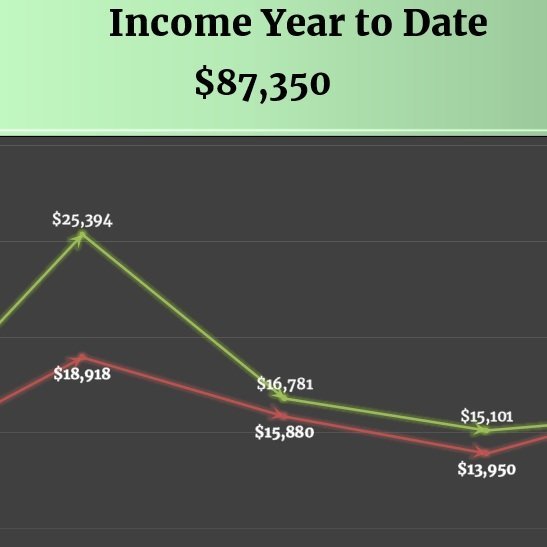

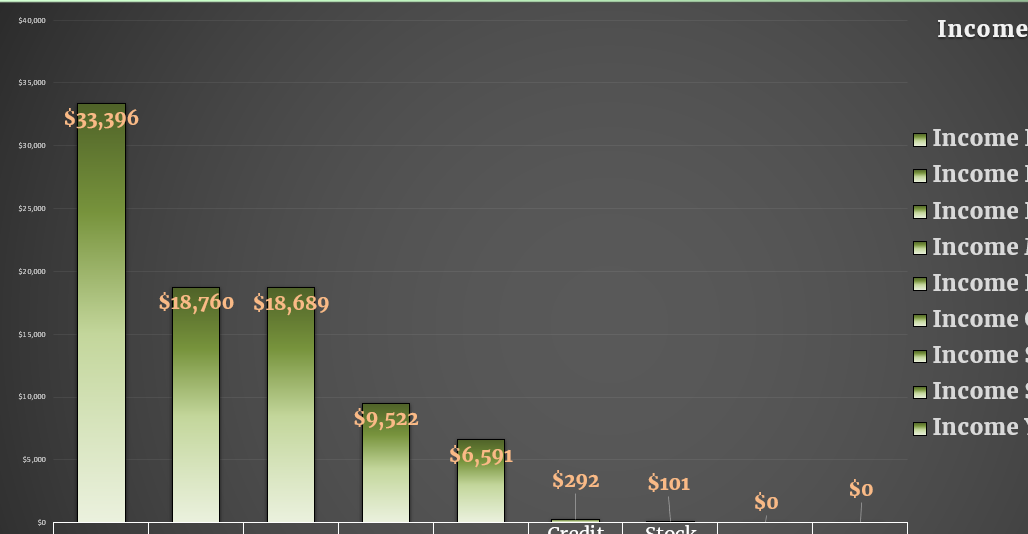

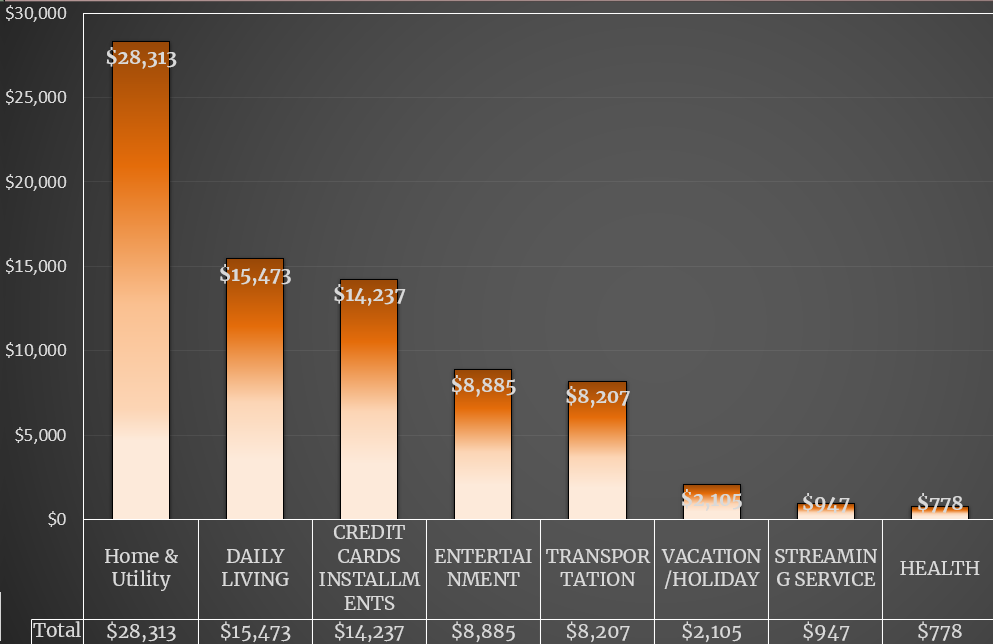

Full interaction Dashboard that tracks both income and expenses together in a line graph. Individual revenue, expense, and profit section that outlines EACH major areas. This allows you to easily see where the bulk of your revenue comes from, and where your expenses go to. There is a sub-category for expenses so you can drill down to the exact expenses which allows you to easily pivot. The interaction dashboard also shows excess, debt to income ratio, yearly distributions, and a rental property breakdown.

Budget input where you add your expenses and revenues for each month. table on top shows you the results instantly for each month

Rental property breakdown if you own rental properties. You can add the details here and it will calculate the ROI, COC, total rental income invested and much more

Property Repair Cost Tracker that allows you to see how much you spend on repairs for your rental properties

Stock Portfolio tab that allows you to place all your stocks. This helps you track your return. There is a table that you can use to see how much money you want to distribute into your favorite stocks.

Debt-to-Income tab where you place your loans and credit card payments. After putting your annual gross salary, it will calculate what you DTI ratio is and helps you track your biggest loans.

Amortization table where you can put the information for your loans. This helps you see how much impact your principle payments will have.

Instruction tab

*ANY pre-filled information on the budget planner is NOT meant to be a guide for you to purchase or follow. It is simply there for instructional purposes.

*INSTRUCTIONS section also on excel. You may email us for any assistance.

A budget planner I created myself. It has everything you need to keep track of your expenses. This budget planner will put you on the right path to success! Keep track of what you make, spend, and how much you’re actually profiting Month over Month. The budget planner also has a tab for rental properties, stocks, amortization schedule, Debt-to-income ratio calculator, and a repair tracker for rental properties. ANY update I make to my budget planner will be shared with buyers for FREE. Additionally, when the new year comes along, a new budget planner will be sent as well with updates.

INCLUDES THE FOLLOWING TABS:

Full interaction Dashboard that tracks both income and expenses together in a line graph. Individual revenue, expense, and profit section that outlines EACH major areas. This allows you to easily see where the bulk of your revenue comes from, and where your expenses go to. There is a sub-category for expenses so you can drill down to the exact expenses which allows you to easily pivot. The interaction dashboard also shows excess, debt to income ratio, yearly distributions, and a rental property breakdown.

Budget input where you add your expenses and revenues for each month. table on top shows you the results instantly for each month

Rental property breakdown if you own rental properties. You can add the details here and it will calculate the ROI, COC, total rental income invested and much more

Property Repair Cost Tracker that allows you to see how much you spend on repairs for your rental properties

Stock Portfolio tab that allows you to place all your stocks. This helps you track your return. There is a table that you can use to see how much money you want to distribute into your favorite stocks.

Debt-to-Income tab where you place your loans and credit card payments. After putting your annual gross salary, it will calculate what you DTI ratio is and helps you track your biggest loans.

Amortization table where you can put the information for your loans. This helps you see how much impact your principle payments will have.

Instruction tab

*ANY pre-filled information on the budget planner is NOT meant to be a guide for you to purchase or follow. It is simply there for instructional purposes.

*INSTRUCTIONS section also on excel. You may email us for any assistance.